BUSINESS LOAN

This product is aim at providing working capital to our Clients.

This loan has proper collateral securities in the forms of Land titles, Land sale agreement, Lease offers, Vehicle log book motorcycle log books and chattels.

A client is required to save up to 30% of the total amount of Loan requested

Product and Features:

- Interest charge on flat rate

- Minimum Loan amount UGX. 100,000/=

- Maximum Loan Amount UGX. 20,000,000/=

- Flexible repayment plan

- Loan Period of up to 12 months.

This is a group loan of between 6 to 12 months. Group members’ range from 5 to 25 members.

The benefit is that there is no collateral security needed, Members saving act as a guarantee for the Loan.

Each member of the groups is advice to at least save 2,000/= every week or even more as this would help them to achieved their set goals at the end of the saving circle.

Each member acts as security for each other and each member is to deposit 30% of the loan amount requested as a security for the Loan.

Product and Features:

- Interest charge on flat rate

- Minimum Loan amount UGX. 1,000,000/=

- Maximum Loan Amount UGX 20,000,000/=

- Flexible repayment plan

- Loan Period of up to 12 months.

GROUP LOAN

BODA BODA LOAN

This is a group loan of between 6 months to 12 months. The group consists of between 5 – 10 members. The loan is given in kind (Motorcycle) not Cash. This product is designed to target the unemployed youths who are energetic but lack what to do. The product is based on member’s guarantees and secondary security is the motorcycles.

The securities require for the loan include Land title, Land sale agreement, Lease offers, Motorcycle logbook, chattels etc.

Maximum down payment of 40% of the total cost of the motorcycle is required.

Product and Features:

- Interest charge on flat rate

- Minimum Loan amount UGX. 1,500,000/=

- Maximum Loan Amount UGX. 6,000,000/=

- Flexible repayment plan

This loan product is designed for both small scale farmers at village levels and commercial farmers. The loan is given both in cash and in kind. This product is designed to help farmers in opening up of bigger farm lands in order to provide food security in the region.

A farmer is required to insure his/ her crop against weather with ENSIBUUKO TECH LTD in partnership with Agro Insurance Consortium.

The securities require for the loan include Land title, Land sale agreement, Lease offers, Motorcycle logbook, Motor vehicle logbook, chattels etc.

A client is required to save up to 30% of the total Loan requested.

Product and Features:

- Interest charge on flat rate

- Minimum Loan amount UGX. 1,000,000/=

- Maximum Loan Amount UGX. 20,000,000/=

- Flexible repayment plan

- Loan Period of up to 12 months.

AGRICULTURAL LOAN

ASSET FINANCING

Asset Financing is designed to enable the Customers realize the dream of owning assets. Let it be a brand new car, plant and Machinery, equipment, tractors, etc., we shall make it possible through the Lanterns Microfinance Asset Financing.

The secondary security is the asset it self, the Asset remains in the name of Lanterns Microfinance until the clients make the final payment.

Other securities include Land title etc.

Maximum down payment of 50% of the total cost of the Asset is required.

Product and Features:

- Interest charge on flat rate

- Minimum Loan amount UGX. 1,000,000/=

- Maximum Loan Amount UGX. 90,000,000/=

- Flexible repayment plan

This is a short term loan that helps parent and guidance to pay school fees for their children. The source of income to help clear the loan should be clearly stated by the borrower.

The securities require for the loan include Land title, Land sale agreement, Lease offers, Motorcycle logbook, Motor vehicle logbook, chattels etc.

Product and Features:

- Interest charge on flat rate

- Minimum Loan amount UGX. 100,000/=

- Maximum Loan Amount UGX. 5,000,000/=

- Flexible repayment plan

- Loan Period of up to 4 months.

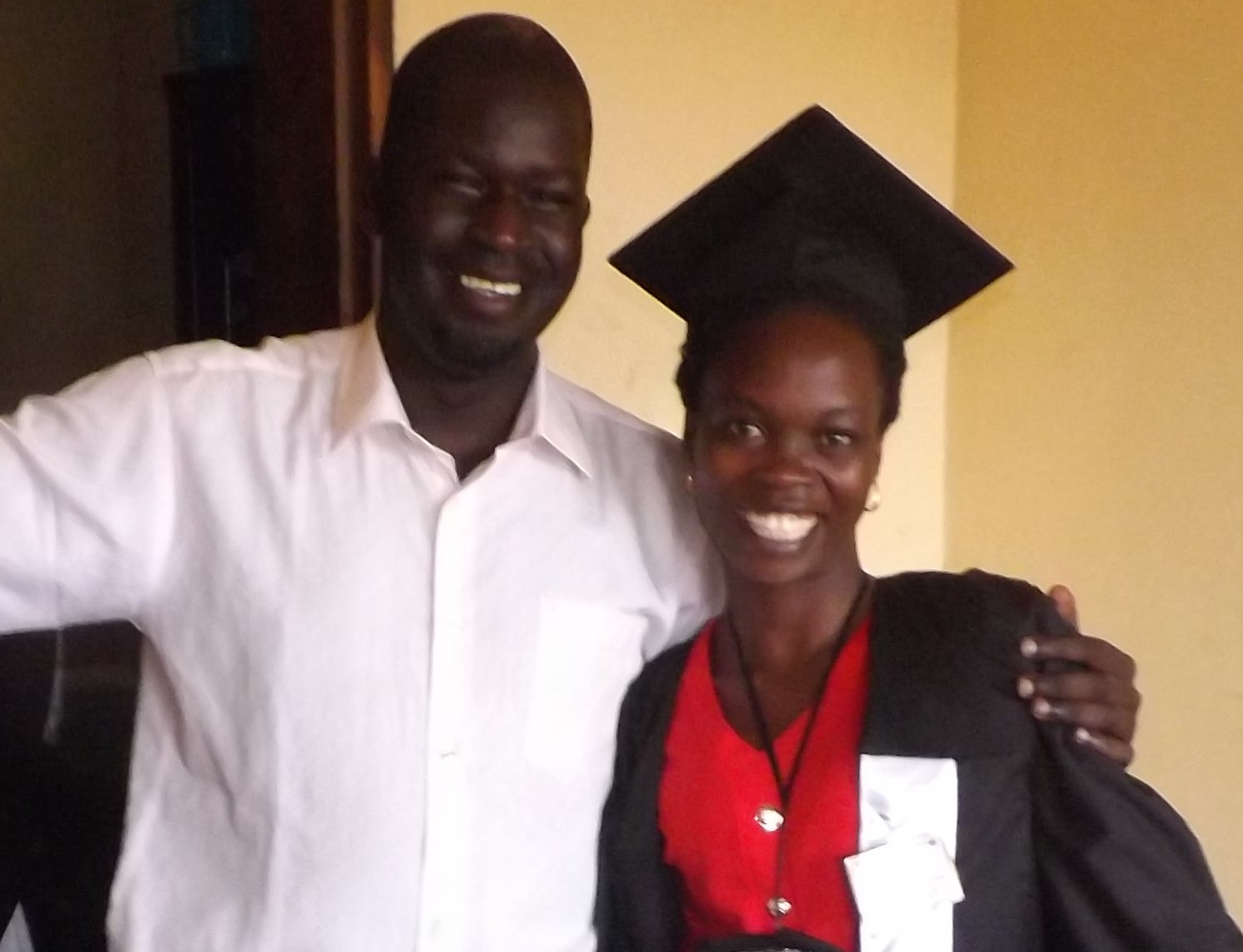

SCHOOL FEES LOAN

CHAP-CHAP MOBILE LOAN

This is a mobile banking platform that enables you to transact and access our services i.e. Deposit, withdrawals, Loans, Check Account balance, Mini-Statements etc. using your mobile phone or device anywhere, anytime as long as there is network coverage. The service targets Farmers in the rural areas as it cheapens their cost of movement from time to time. Our farmers can access this services through both MTN & AIRTEL Network.

Don’t get stranded get an instant Loan today!!!

Our farmers are fully protected under weather index Insurance. Dial *284*10#

The farmers pay as low as 30,000 ($8) per acre

No insurance officer ever visits their farm. They use satellite and GPS to monitor and determine a pay-out for our farmers should they experience weather related losses. It’s that simple!

Immediately the farmers Insure their crops, they qualify for our agricultural Loans that help boost up their working capital which allows them to buy seeds, fertilizers, opening up their farmland for planting, weeding, Harvesting and transporting their farm product to the market for sale.

Get a good harvest and don’t get stranded we will finance you!!

CROP INSURANCE

QUICK LINKS

OUR ADDRESS

P.O BOX 247, SOROTI, UGANDA

PLOT 54 OLD MBALE RD, OPPOSITE MUNICIPAL SCHOOL AT JCK APPARTMENT UPPER FLOOR.

Tel: (+256) 414 - 671 - 607 Mobile: (+256) 705 - 042 - 155

Email: info@lanternsmicrofinance.com

MAP TO OUR OFFICE

FIND US ON SOCIAL MEDIA